Moving from Michigan to Texas can be an exciting adventure, but the transition requires thoughtful planning and organization. Whether you’re relocating for work, family, or a new adventure, these expert tips will ensure your move is as smooth as possible. Let’s break down the essential steps to help you navigate this cross-country move with ease.

1. Understand the Differences Between Michigan and Texas

Before you even begin packing, it’s essential to understand the differences between Michigan and Texas. These differences will help you adjust to your new environment more quickly and prepare for any challenges that may arise.

- Climate: One of the most significant changes you’ll experience is the climate. Michigan has a cold, snowy winter with mild summers, while Texas has hot summers and mild winters, with occasional snow in the northern parts. Be prepared for warmer weather, especially if you’re moving to the southern regions of Texas, such as Houston or Austin.

- Cost of Living: Texas generally has a lower cost of living than Michigan, particularly in major cities such as Dallas and San Antonio. Housing costs are often more affordable, and Texas has no state income tax, which could result in significant savings.

- Culture: Texas has a distinct cultural identity. The state is known for its southern hospitality, Tex-Mex cuisine, and a strong emphasis on outdoor activities. Whether you’re a fan of country music, barbecue, or football, Texas offers a unique experience.

2. Plan Your Moving Timeline

Planning is key to any successful move. Establish a moving timeline to manage logistics and avoid last-minute stress. Start your planning at least two months before your moving date.

- Start Early: Begin by decluttering your home, organizing your belongings, and deciding what to keep, donate, or sell. This will make packing easier and help you save money on moving costs.

- Book Movers or Rental Trucks: If you plan on hiring a moving company, make sure to book them early, especially if you’re moving during the summer months when movers are in high demand. Alternatively, if you’re renting a truck, book your reservation at least a month in advance.

- Pack Smart: Begin packing non-essential items well in advance. Pack up your seasonal clothes, books, or decorations first. As your move date approaches, focus on packing essentials such as kitchenware, toiletries, and everyday clothing.

3. Choose the Best Moving Method

When planning your move, you’ll need to decide whether to hire professional movers or handle the move yourself. Both options have pros and cons, depending on your needs.

- Hiring Professional Movers: Professional movers take care of everything, from packing your belongings to unloading them at your new home. This option is great if you want to minimize stress and ensure that your items are moved safely. Be sure to research and get quotes from multiple moving companies to find the best deal.

- Renting a Moving Truck: If you prefer a DIY approach, renting a moving truck can save you money. Companies like U-Haul, Penske, and Budget offer moving trucks in a variety of sizes. Just be prepared for the physical labor involved, such as loading and unloading your belongings.

- Shipping Your Belongings: If you don’t have a lot of items, you may opt for shipping services, such as using pods or freight services. This method can be more affordable, but it may take longer for your items to arrive.

4. Change Your Address and Update Important Documents

Once your move is confirmed, be sure to update your address with the USPS and notify other relevant institutions of the change. Some of the places you need to notify include:

- Post Office: You can change your address online or in person at the local post office.

- DMV: Don’t forget to update your driver’s license and vehicle registration with the Texas Department of Motor Vehicles (DMV).

- Banks and Credit Cards: Notify your bank and credit card companies about your change of address.

- Insurance Companies: Update your car, health, and homeowner’s insurance policies to reflect your new Texas address.

5. Understand Texas’s Moving Laws and Regulations

Every state has different moving laws and regulations, so it’s essential to familiarize yourself with Texas’s rules for moving.

- Vehicle Registration: You’ll need to update your vehicle registration and driver’s license within 90 days of moving to Texas. Be prepared to show proof of Texas insurance and pass a vehicle inspection.

- Sales Tax: Texas doesn’t have a state income tax, but it does have a sales tax. Make sure you’re familiar with Texas sales tax rates for everyday purchases.

6. Prepare for the Texas Lifestyle

Adapting to life in Texas might require a shift in lifestyle. Here are some things to consider:

- Weather: The hot summers in Texas can be intense. Invest in air conditioning for your new home if it doesn’t have one, and always stay hydrated during the warmer months. If you’re moving to an area with frequent thunderstorms, make sure your home is prepared with storm-resistant features.

- Transportation: Texas is a vast state, and most of its regions are spread out across the state. While public transit exists in larger cities like Houston and Dallas, owning a car is typically essential for getting around.

- Culture: Texans take pride in their state, and sports such as football, baseball, and basketball are highly popular. Embrace Texas culture by attending local events, trying authentic Texas BBQ, and getting involved with your new community.

7. Update Your Utilities and Services

Be sure to arrange for utilities at your new Texas home ahead of time. Here are some utilities and services you should handle:

- Electricity: Texas has a deregulated electricity market, meaning you can shop for the best electricity provider. Conduct thorough research and select a provider that best suits your needs.

- Water and Sewer: Contact your new water utility provider to set up service before you arrive.

- Internet and Cable: Schedule your internet and cable installation in advance to ensure that you’ll have service as soon as you move in.

8. Texas-Specific Moving Tips

Here are some additional Texas-specific moving tips to consider:

- Moving to Large Cities: If you’re moving to a large Texas city like Dallas or Houston, traffic can be a challenge. Plan your commute and explore alternate routes to avoid delays.

- Rural Areas: If you’re moving to a rural area, services might be more spread out. Make sure you research local businesses and services before making the move.

- Weather Prep: Texas is known for its extreme weather, including hurricanes, tornadoes, and droughts. Prepare your new home with the appropriate safety measures and emergency supplies.

Frequently Asked Questions (FAQs)

1. How do I find a moving company to help me relocate from Michigan to Texas?

To find a reliable moving company, start by researching reviews and asking for recommendations from friends or online groups. Request quotes from several companies and compare their services and prices.

2. How much does it cost to move from Michigan to Texas?

The cost of moving from Michigan to Texas depends on several factors, including the size of your move, the distance, and whether you hire professional movers. On average, a long-distance move can cost anywhere from $2,000 to $5,000 or more.

3. Do I need to register my vehicle in Texas after moving?

Yes, you’ll need to register your vehicle with the Texas Department of Motor Vehicles (DMV) within 90 days of your move. Please ensure you bring proof of Texas car insurance and your vehicle’s inspection report.

4. What are the best cities to move to in Texas?

Popular cities in Texas include Austin, known for its vibrant live music scene; Dallas, renowned for its job opportunities; Houston, recognized for its diversity; and San Antonio, celebrated for its rich history. Research each city to determine which best suits your lifestyle.

5. Do I need to prepare for hurricanes in Texas?

If you’re moving to a coastal area or a place prone to hurricanes, it’s essential to prepare your home with storm-resistant measures. Keep an emergency kit, and stay informed about weather patterns.

With careful planning and preparation, your move from Michigan to Texas can be a rewarding experience. Keep these tips in mind to ensure a smooth transition to your new home in the Lone Star State.

Buzzmoving connects you with top-rated movers across the country, offering exceptional services for a seamless move. Request a free quote today and get expert solutions tailored to your needs.

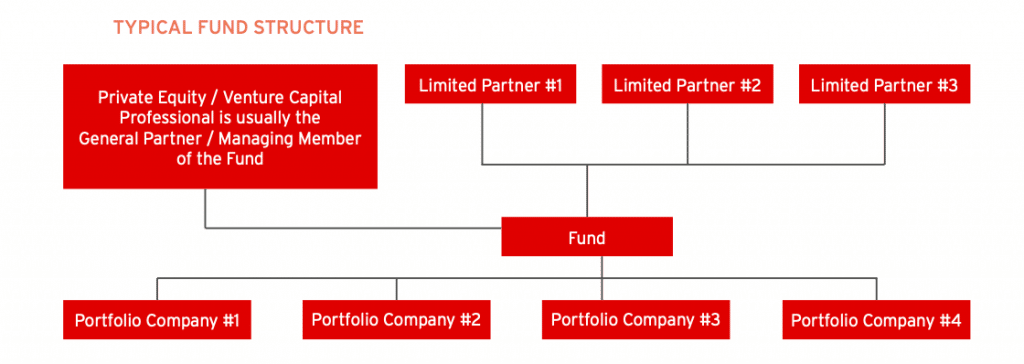

Islamic Private Equity Fund Structure Download Scientific Diagram

Islamic Private Equity Fund Structure Download Scientific Diagram Private Equity Fund Structure ASimpleModel.com

Private Equity Fund Structure ASimpleModel.com