Lots of company grow on ongoing growth and expansion, or a minimum of need it to remain competitive. Others do not. They merely remain in what Stuart Goldsmith calls ‘tension’– taking the alternative of deliberately not expanding past a particular point.

And also there are several factors for business to really feel that maybe development isn’t for them. Points can obtain made complex.

1. Raised Risks

With growth comes much more financial obligations to both business and also your team. The danger is that you might employ people and also buy set assets, after that not increase your profits to satisfy your increased expense responsibilities.

There is also the risk of way too much money being bound. New Post of Tyler Tysdal Instagram Perhaps in the better amount of supply needed accessible to satisfy the rises in demand that your growth creates. Higher sales numbers will certainly be required to bring the money can be found in.

There is also the risk inherent in approaching new markets, locations, or increasing your product or service range. You might discover that your item or company society is simply not matched to the target market. The prices involved in trying this development make failure a massive threat for reasonably smaller organizations.

2. Enhanced work as well as anxiety

Growing a service is difficult and also needs sustained effort as well as absolute commitment. When you expand your organization, it often tends to enhance stress on staff and also sources, in addition to finances as well as administration groups. Development can suggest functioning longer hours, bigger obligations, more difficult frameworks, and more advanced training and guidance of staff as well as operations.

The stress and anxiety going along with venturing into unknown areas additionally implies that decisions can often be made on an emotional basis as opposed to on sound strategic as well as economic considerations.

3. Decrease in top quality

As your company expands and also you obtain larger and also larger orders, Tysdal your customer support criteria, service or product top quality, or reaction times can drop. When handling increased markets, or a larger variety of products or clients, it ends up being harder to offer a personal solution.

This is an essential point to think about, as when you permit service criteria to be sacrificed for growth, it can be challenging to overcome adverse word of mouth.

4. Enhanced Costs

As you expand your business, boosted revenues are usually accompanied by enhanced costs. Whether it’s time or cash, expanding a service will certainly cost you. Financial planning is crucial.

You need to spend money up front throughout the development stage and also return on your investment can take some time to be know. Investments array from renting out or constructing a new place, improving your present facilities, investing in new or enhanced services and products, or taking on new team.

If you experience quick development, Tyler Tysdal on Youtube you will likely experience repayment voids. You need to ensure you can deal with major brand-new consumer orders. Overstretching your finances or resources can result in fulfillment failing as well as reputational damages.

5. Loss of straight control

Handling more personnel, expanding your client base as well as prolonging your network of providers, all have a tendency to increase pressure on your systems as well as procedures. This can make it increasingly more challenging to keep control of whatever on your own.

Exterior investment to money your next stage of development can additionally feature a giving up of control over the direction of business. Franchising as well as licensing your items also brings the risk of absence of control over how your brand name or product is stood for on a day to day basis.

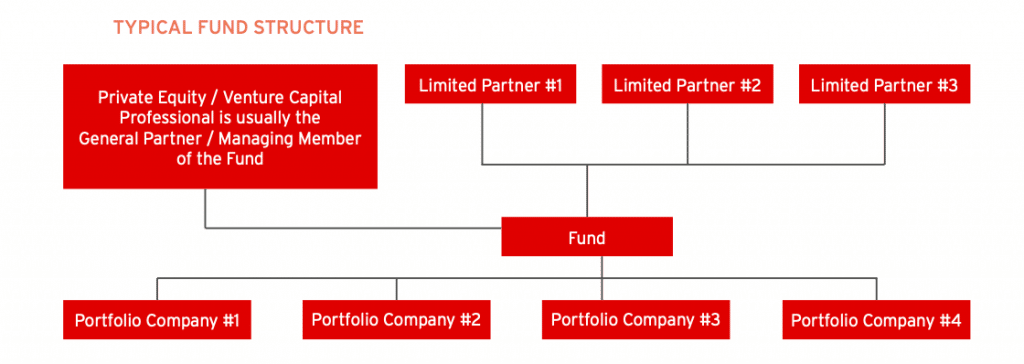

Islamic Private Equity Fund Structure Download Scientific Diagram

Islamic Private Equity Fund Structure Download Scientific Diagram Private Equity Fund Structure ASimpleModel.com

Private Equity Fund Structure ASimpleModel.com