Private equity firms achieve this by purchasing smaller companies, increasing their worths and selling them at a profit. The process can take numerous years and comes with high risks. If a business does not see an increase in worth that covers the costs of improvements, or if the company has an obstacle, the investors might not make an earnings (titlecard capital fund).

For instance, a private equity firm may pick to buy a company that develops mobile phone apps, then induce a former software application advancement executive to supervise the business’s operations. The business benefits from the former executive’s proficiency, while the private equity group increases its opportunities to turn the business into a lucrative enterprise.

Another aspect that private equity brings to small company is the capital infusion needed to replace and update outdated devices. For example, a custom-made retailing business might gain from a capital infusion that would enhance the procedures of developing new logo designs for clients, applying those logo designs to the clients’ merchandise and dispersing the product to stores that offer T-shirts, essential chains and coffee mugs.

Charleston Drink Company, a small business that sells premium bloody Mary mix, took in $50,000 in income in 2010. After receiving financing from private equity investors, the company broadened its distribution and forecasted its income would reach $250,000 in less than three years.

If you’re thinking of moving your business to the next level, you might be considering a partnership with a private equity (PE) firm to enhance your service. But how do you determine which firm is the best match for your company the firm that will enable you to attain your strategic and monetary objectives? Although the procedure of discovering the perfect partner can be difficult, knowing what to look for will help narrow your search considerably.

Work With A Private Equity Firm

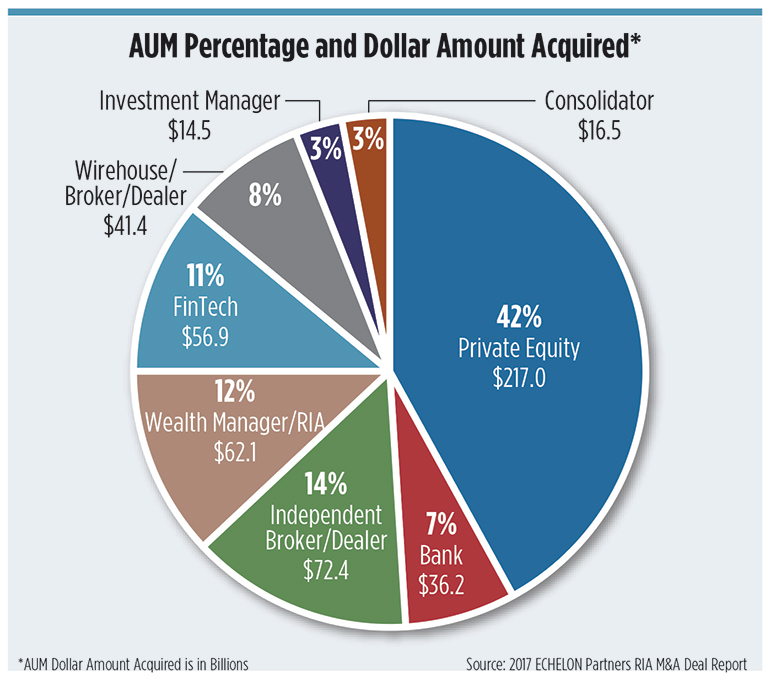

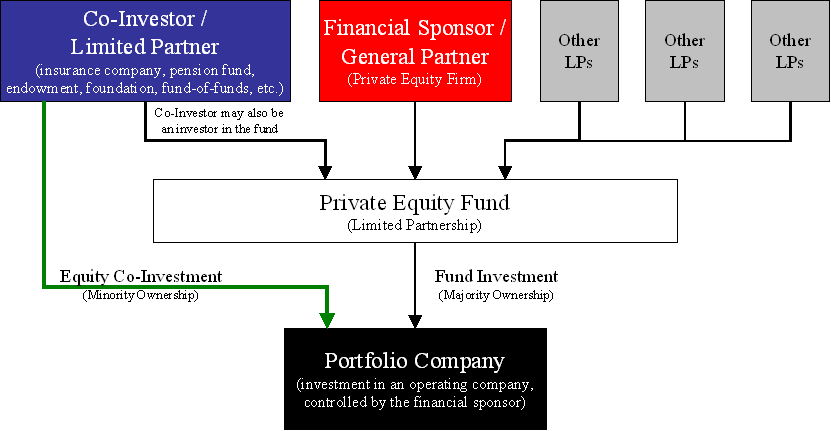

The PE firm raises money from investors (i.e., pensions, structures, trusts, people) and creates a financial investment car called a “fund.” The mission is to make acquisitions of companies with the purpose of making the most of returns for investors. Each PE fund is usually needed to return financier’s cash within ten years, with a required to invest the committed money within 6 years.

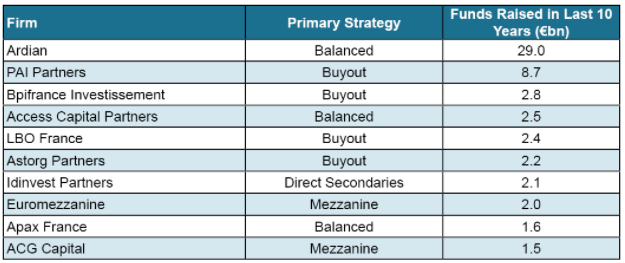

Furthermore, some PE companies may have distinct know-how in deal structures and industries based upon the cumulative experiences of the firm’s management and investors. Here are some of the most crucial aspects to remember when looking for a private equity firm to invest in your organisation. The initial step in finding the best PE firm is finding the firms that invest in your market; doing so assists ensure they comprehend what makes your business unique and why it’s an excellent investment.

The optimum buyer with industry experience will be the purchaser that can assist grow the business, creating chances for workers, and maximizing the financial investment returns for all (civil penalty $). The PE firm will usually have an established group of market experts to drive profitability and development for your company. You need to review the PE firm’s past and existing investments to see if they are similar to your service.

Numerous PE companies are “market agnostic” however can still supply substantial value to your organisation. Their technique is somewhat different than that of the industry-specific PE firm: The generalist financier is able to view growth chances through fortifying the resources around you (partner indicted counts). Rather of enforcing the conventional industry trajectory on your company, an industry-agnostic PE firm may bring brand-new processes, innovation, and management that accept your vision.

Which part of the business cycle your business remains in figures out which private equity firm is best matched to partner with you. Some companies specialize in the early stages and advancement of a service, whereas others are wanting to invest entirely in fully grown companies. Identify how your company will continue to grow.

A Beginner’s Guide To Private Equity – Entrepreneur

An essential advantage of partnering with a PE firm is the ability to promote the ongoing development of your company with access to additional capital. Private equity funds come in numerous various sizes based upon the quantity of dedicated capital raised from investors. Each fund will cap the amount of financial investment in each company to a particular portion based on the overall readily available capital.

So, you need to make certain that the fund is large enough to purchase your business and make extra capital investments to grow your business. To even more illustrate, say you are selling your company, which has a business value of $50 million. The PE firm isn’t going to invest entirely with cash; it will utilize debt to help with the acquisition.

The resulting earnings to you would appear like the following: In this circumstance, you receive 85% of your company’s worth, and through reinvestment you own 25% of the business moving forward. If the money investment is near the maximum investment limit, the acquisition might not be an ideal fit. You desire to pick a fund that has additional investment capability.

Depending on the size of your company, sometimes the financial investment is thought about a platform investment for the PE firm. A platform investment is normally a larger business in which the PE firm invests that grows by either getting other companies to contribute to the platform or by enhancing natural growth (racketeering conspiracy commit).

Somewhere in between 75% and 80% of private equity acquisitions are thought about add-ons to an existing platform investment. Be reasonable about the value of your business. If your organisation is on the smaller sized side, the purchase of your company by a strategic buyer (an existing company) is likely. Approximately 85% of all business sold go to other companies (this includes PE firm add-ons).

How To Choose The Best Private Equity Firm?

If you are not prepared to retire, discover a PE firm that will purchase a business of your size and motivate the autonomy of the company as a separate platform, or one that needs you as part of its platform company. Be in advance about your personal goals, which will help you recognize the best partner. private equity fund.

Historical actions often show those of the future. PE companies release existing and past financial investments, so look closely at which companies they have actually bought and in what capacity – $ million cobalt. Ask to speak to the service owner of the portfolio business to assess how the PE partner was to deal with after conclusion of the deal.

Specific funds can have their own timelines, financial investment objectives, and management philosophies that separate them from other funds held within the exact same, overarching management firm. Successful private equity companies will raise lots of funds over their life time, and as firms grow in size and intricacy, their funds can grow in frequency, scale and even uniqueness. To find out more about business partner and - go to the videos and -.

In 15 years of handling properties and backing several entrepreneurs and investors,Tyler Tysdal’s companies managed or co-managed , non-discretionary, approximately $1.7 billion in properties for ultra-wealthy families in markets such as healthcare, gas and oil , real estate, sports and entertainment, specialized financing, spirits, technology, consumer goods, water, and services companies. His group advised clients to buy nearly 100 entrepreneurial companies, funds, personal loaning offers, and real estate. Ty’s performance history with the personal equity capital he deployed under the first billionaire customer was over 100% yearly returns. Which was throughout the Great Recession of 2008-2010 which was long after the Carter administration. He has actually produced numerous millions in wealth for clients. However, given his lessons from dealing with a handful of the accredited, extremely sophisticated people who might not appear to be pleased on the benefit or understand the possible downside of a offer, he is back to work entirely with business owners to help them sell their companies.

A critical aspect in choosing a PE firm is understanding where you fit in the business post-transaction, and if that role is appealing. Not all PE companies’ investment structures are the same, and understanding what type of financial investment you want is important in selecting a partner. $ million cobalt. Investments in companies handle several forms, and each firm has a preferred investment structure.

The financial obligation released by a private equity firm may likewise contain an equity element, such as warrants or alternatives. Because of the level of involvement the group will have with your business, the financial obligation structures will feel more like equity once the funding happens. The PE firm will generally need month-to-month reports and meetings as though it is your equity partner.