A performance measure utilized to assess the performance of an investment or to compare the performance of a number of various investments. ROI measures the amount of return on a financial investment relative to the investment’s cost (Tyler T. Tysdal lone tree lone). To determine ROI, the benefit (or return) of an investment is divided by the cost of the investment, and the outcome. private equity firm Tysdal.

is revealed as a percentage or a ratio( Source: Investopedia ). The procedure of pursuing innovative market-based services to social problems while adopting a mission to develop and sustain social worth. A technique to handling money that delivers a social dividend and an economic return. A financial investment method that seeks to think about both monetary return and social excellent; socially accountable investors encourage business practices that promote environmental stewardship, consumer security, human rights, and diversity; likewise called sustainable, socially mindful,” green” or ethical investing. Impact financial investment is catching the growing attention of mainstream investors, and everybody is increasingly hearing and talking about it. During the past 12 months, I have actually listened to people talk about impact investing more than in all the previous years combined. There is a growing awareness and an emerging community in the UK and Europe, following on from the terrific work performed in the United States up until now. In the next paragraphs, you will find a couple of crucial points, definitions and examples that can help to begin comprehending the idea and its relevant value in our daily conversations, decisions and actions. The main objective is to get an initial view, learn more about some of the individuals and companies leading the market, and to share it with anyone that can benefit from it. Tysdal tree lone tree. This is a section of investment that has actually been growing quickly, and the Global Impact Investors Network (GIIN) estimates from the newest annual survey that there is now in impact investing assets which is roughly double that of in 2015. Thomson Reuters Structure reported that members of Toniic, a global financial investment club for impact investors, have actually seen similarly incredible development with members.

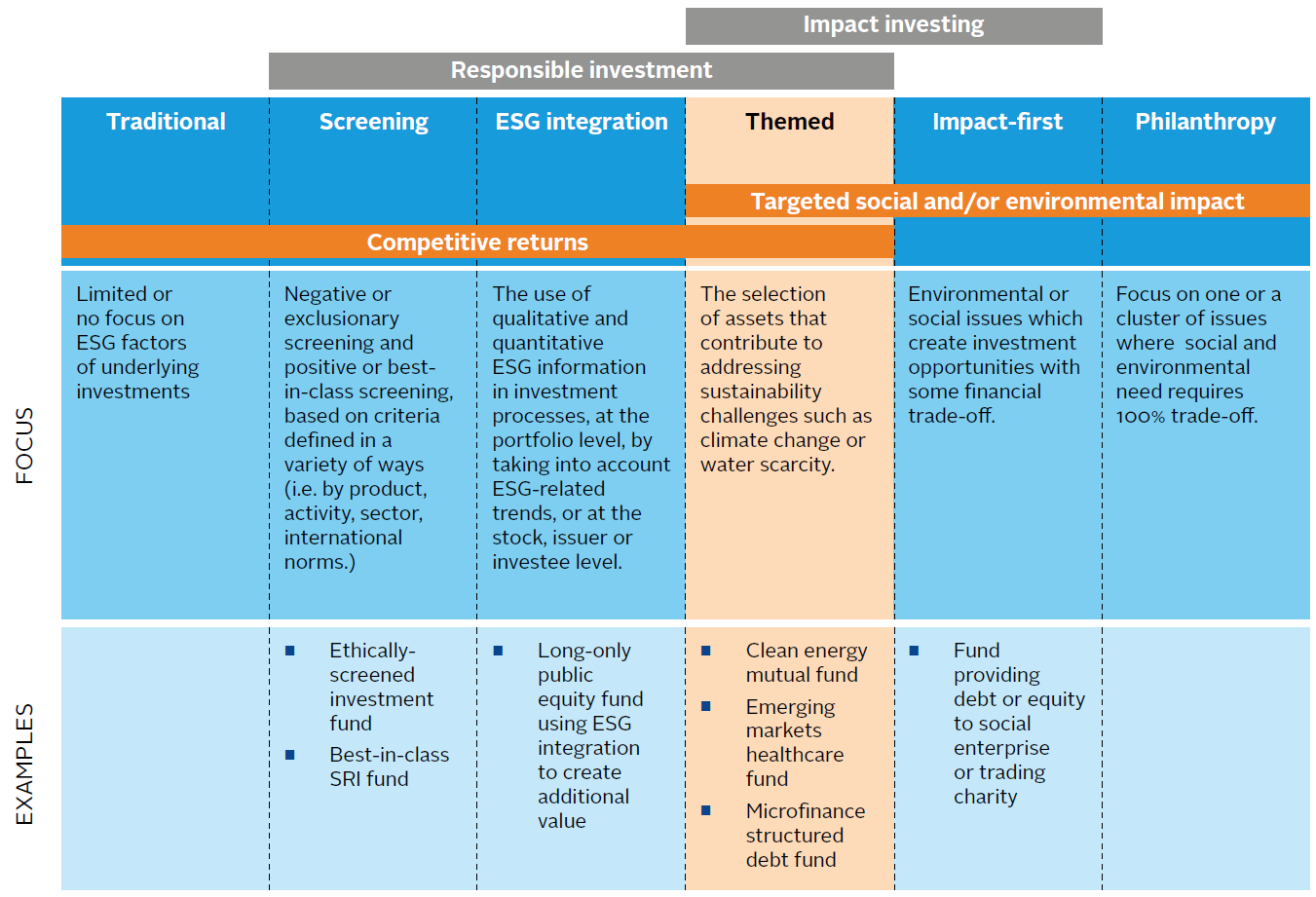

having their integrated of impact investments, which are up from $1.65 billion in 2016. JP Morgan reported that impact financial investments, an emerging property class, “uses the possible over the next ten years for invested capital of$ 400 billion$ 1 trillion and profit of$ 183$ 667 billion” Along with impact investing other similar ideas have actually developed such as conscious industrialism, sustainable investment, and ethical financial investment. Socially responsible investment (SRI), which is a distinct structure for selecting financial investments based.

on ecological, social and governance( ESG) criteria is not brand-new to investors. The distinction today is that impact investors are even more proactive in their intent for positive impact rather than merely preventing the negative impacts. As someone who is reading this, it may not surprise you that the world’s biggest global problem is now drawing in impact investments. So what makes up impact? There is a wide range of issue that requires addressing these include the social concerns such as humanitarian crisis of refugees, alleviating the impact from environment change-induced extreme weather condition events, reducing air contamination in cities, addressing ocean plastics, changing our energy system to tidy energy or sustainable ways of food production, to providing access to quality education and health care. These have assisted focus on what needs to be accomplished and determined in order to fix the world difficulties – Tyler T. Tysdal titlecard capital group. This is now galvanising the international effort in addressing the most significant obstacles faced by humanity. For lots of Impact investors and funds, the 17 Global Objectives have actually ended up being a guideline for essential efficiency indications. As this Forbes explainer video programs, impact financial investment” integrates both the strenuous analytics of standard financial investment and the heart of philanthropy (investors state prosecutors).” Offered the severe challenges, and sometimes irreparable damage, that the world is dealing with, there is a long-lasting.

and basic shift in society with businesses now anticipated to do great and be function driven. Professional Photographer: Paul Hilton/Bloomberg News. BLOOMBERG NEWS Al Gore’s documentary, An Inconvenient Truth, highlighted the ecological obstacles we were facing more than 10 years ago. He didn’t stop there and went on to discovered Generation Financial investment Management in 2004 together with the head of Property Management at Goldman Sachs, David Blood,” To deliver remarkable investment performance by regularly taking a long-term view and fully incorporating sustainability research within an extensive structure of standard financial analysis. Among the challenges that well-intended funds like this one had been facing in the past was the lack of circulation with size and scalability potential, but this is already changing. Quick forward to today, Blackrock, the world’s largest investment company handling over$ 6 trillion of possessions is telling business to consider their social duties. [+] Professional Photographer: Mark Kauzlarich/Bloomberg 2018 Bloomberg Financing LP “… society progressively is turning to the private sector and asking that business react to more comprehensive societal challenges. Indeed, the general public expectations of your business have actually never been higher. Society is requiring that business, both public and private, serve a social function.

To flourish over time, every company should not only deliver financial efficiency but also reveal how it makes a positive contribution to society. They went on to raise a record $471 million in 2016 for an impact fund that buys cancer research initiatives and transforms them into commercially effective businesses. The bank has dedicated to investing a minimum of$ 5 billion of personal customer.

assets to Sustainable Advancement Goal-related impact investing, in a technique that consists of partnering with the Rise Fund a brand-new$ 2 billion social impact fund. Their white paper for the World Economic Online forum yearly meeting 2017 unveils a blueprint for carrying personal wealth towards this – partner tivis capital Tysdal. The follow-up report in 2018 shares 5 lessons to help bridge the$ 5-7 trillion financing space to accomplish the 17 Global Objectives: Portfolios should think about consisting of Multilateral Advancement Bank bonds. Monetary firms need to interact to close the SDG-funding gap. Philanthropy is moving away from.

Existed Time Sale

just offering money to more quantifiable techniques. Companies and social business owners should interact. For their efforts, actions and commitment, they have been called sustainability leaders in the Dow Jones Sustainability Index. If you are interested to learn how you can approach sustainable investing, according to James Gifford, UBS head of Impact Investing, there are three main methods: Exclusions ESG Integration Impact Investing There is a common misunderstanding that a service that goes for the double bottom line of impact and financial returns have lower returns. For instance, a 2015 study by Friede, Busch, and Bassen( ESG and Financial Performance: Aggregated Proof from more than 2,000 Empirical Studies, Journal of Sustainable Financing & Investment) discovered a non-negative relationship in between investing along ecological, social, and governance( ESG )factors and corporate financial efficiency in around 90% of the more than 2,000 empirical studies carried out in between 1970 and 2014. More of this to be covered in future short articles. Impact investing is here to remain and to grow exponentially over the next decade and beyond (harvard business school). It is easy, our future depends on it and people are comprehending this at last. The philanthropic method of giving to charities is no longer the only way to make a distinction and impact investing is now seen as an essential motorist for favorable change.