Private equity companies achieve this by purchasing smaller business, increasing their values and offering them at a profit. The procedure can take several years and features high dangers. If a business does not see an increase in value that covers the costs of improvements, or if the company has a setback, the investors might not make a revenue (private equity firm).

For example, a private equity firm may pick to acquire a company that develops smart device apps, then bring on a previous software development executive to manage the business’s operations. The business gain from the previous executive’s competence, while the private equity group increases its chances to turn the business into a successful business.

Another facet that private equity brings to little business is the capital infusion required to replace and upgrade outdated devices. For instance, a custom retailing company might take advantage of a capital infusion that would improve the processes of designing brand-new logo designs for clients, applying those logo designs to the clients’ product and dispersing the merchandise to shops that offer Tee shirts, essential chains and coffee mugs.

Charleston Drink Business, a small business that offers premium bloody Mary mix, took in $50,000 in revenue in 2010. After getting funding from private equity investors, the company expanded its circulation and anticipated its revenue would reach $250,000 in less than 3 years.

If you’re thinking of moving your company to the next level, you may be considering a partnership with a private equity (PE) firm to reinforce your company. However how do you figure out which firm is the very best match for your business the firm that will enable you to achieve your strategic and financial goals? Although the process of finding the perfect partner can be difficult, knowing what to search for will assist narrow your search substantially.

How Private Equity Can Boost Company Performance?

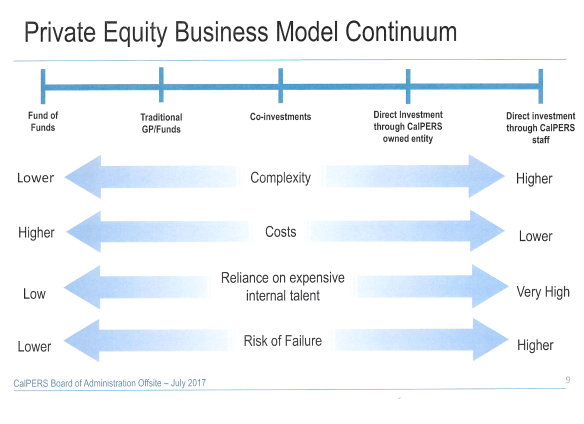

The PE firm raises cash from investors (i.e., pensions, structures, trusts, people) and creates an investment lorry called a “fund.” The mission is to make acquisitions of companies with the purpose of maximizing returns for investors. Each PE fund is normally required to return investor’s money within 10 years, with a required to invest the committed money within six years.

Additionally, some PE companies may have distinct expertise in deal structures and markets based on the cumulative experiences of the firm’s management and investors. Here are some of the most essential aspects to bear in mind when looking for a private equity firm to buy your organisation. The primary step in finding the right PE firm is finding the companies that invest in your industry; doing so assists guarantee they comprehend what makes your company special and why it’s a good financial investment.

The optimum buyer with market experience will be the buyer that can help grow the business, producing chances for employees, and optimizing the investment returns for all (conspiracy commit securities). The PE firm will normally have an established group of industry specialists to drive success and development for your company. You must evaluate the PE firm’s past and present investments to see if they resemble your organisation.

Numerous PE companies are “industry agnostic” but can still offer significant worth to your business. Their approach is somewhat different than that of the industry-specific PE firm: The generalist financier has the ability to view growth opportunities through supporting the resources around you (investment fund manager). Instead of enforcing the traditional market trajectory on your business, an industry-agnostic PE firm might bring brand-new procedures, technology, and management that welcome your vision.

Which part of business cycle your business is in figures out which private equity firm is best fit to partner with you. Some firms specialize in the early phases and development of an organisation, whereas others are seeking to invest solely in fully grown business. Recognize how your company will continue to grow.

The End Of Private Equity Is Coming

A crucial benefit of partnering with a PE firm is the ability to promote the ongoing development of your company with access to extra capital. Private equity funds can be found in several sizes based on the quantity of dedicated capital raised from investors. Each fund will cap the quantity of financial investment in each company to a particular portion based on the overall offered capital.

So, you need to ensure that the fund is large enough to buy your company and make extra capital expense to grow your business. To further highlight, state you are offering your service, which has an enterprise worth of $50 million. The PE firm isn’t going to invest solely with cash; it will utilize financial obligation to facilitate the acquisition.

The resulting earnings to you would look like the following: In this scenario, you receive 85% of your business’s worth, and through reinvestment you own 25% of the business going forward. If the cash investment is near the maximum investment limitation, the acquisition might not be an ideal fit. You want to select a fund that has additional financial investment capability.

Depending on the size of your company, sometimes the financial investment is considered a platform financial investment for the PE firm. A platform investment is generally a larger business in which the PE firm invests that grows by either acquiring other business to contribute to the platform or by augmenting organic expansion (racketeering conspiracy commit).

Someplace in between 75% and 80% of private equity acquisitions are thought about add-ons to an existing platform investment. Be realistic about the worth of your business. If your organisation is on the smaller side, the purchase of your business by a tactical buyer (an existing company) is most likely. Approximately 85% of all business sold go to other companies (this includes PE firm add-ons).

Here Are The Private-equity Firms That Will Survive A Downturn

If you are not prepared to retire, find a PE firm that will invest in a business of your size and encourage the autonomy of business as a separate platform, or one that requires you as part of its platform business. Be in advance about your individual goals, which will assist you recognize the ideal partner. partner grant carter.

Historic actions often suggest those of the future. PE firms publish existing and past investments, so look closely at which companies they have actually purchased and in what capability – denver district court. Ask to speak with the company owner of the portfolio business to evaluate how the PE partner was to deal with after conclusion of the offer.

Specific funds can have their own timelines, investment goals, and management viewpoints that separate them from other funds held within the same, overarching management firm. Successful private equity companies will raise numerous funds over their lifetime, and as companies grow in size and intricacy, their funds can grow in frequency, scale and even specificity. To find out more about securities exchange commission and also - visit his podcasts and -.

Tyler Tysdal is a lifelong business owner helping fellow entrepreneurs offer their company for optimum value as Managing Director of Freedom Factory, the World’s Best Business Broker situated in Denver, CO. Freedom Factory assists business owners with the biggest deal of their lives.

A vital factor in picking a PE firm is knowing where you suit the business post-transaction, and if that role is appealing. Not all PE companies’ investment structures are the very same, and knowing what kind of investment you desire is important in picking a partner. securities fraud racketeering. Investments in services take on a number of types, and each firm has a favored investment structure.

The financial obligation issued by a private equity firm may likewise contain an equity element, such as warrants or alternatives. Due to the fact that of the level of participation the group will have with your business, the financial obligation structures will feel more like equity once the financing occurs. The PE firm will usually require month-to-month reports and meetings as though it is your equity partner.